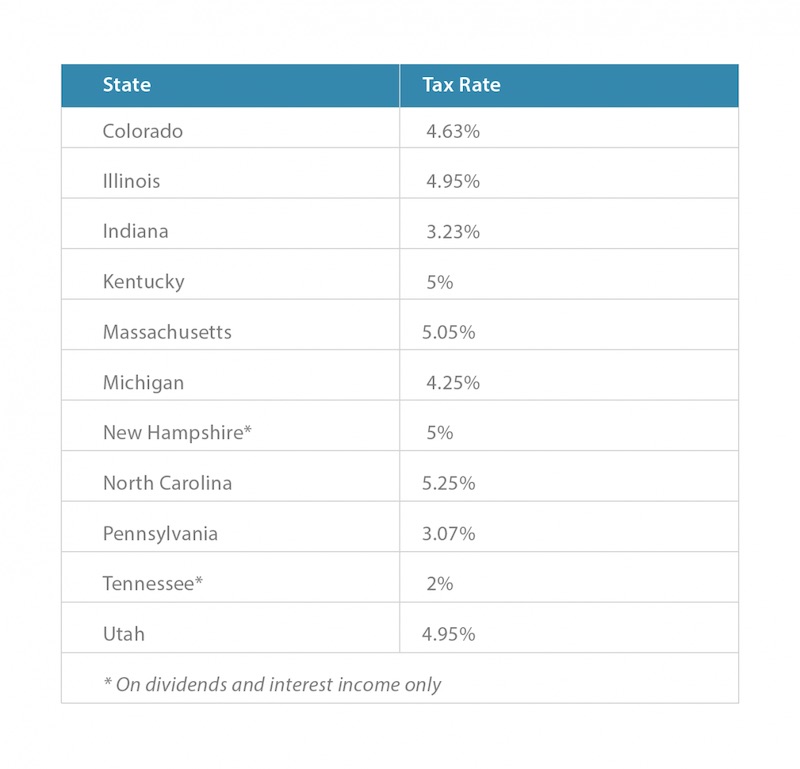

Massachusetts is the most recent state to adopt a graduated rate tax after voters approved the November 2022 ballot measure which created a higher bracket on income over $1 million.įor more on flat taxes, read our January 2023 brief. A new, single tax rate would apply to taxable income for businesses and. This includes 28 states and the District of Columbia that both have a graduated rate today and are not in the process of phasing it out. The flat tax would repeal the existing individual and corporate income taxes. Two-thirds of states with broad-based personal income tax structures have a graduated rate. Four of these flat rate structures (Colorado, Illinois, Michigan, and Pennsylvania) are enshrined in the state constitution and are therefore difficult to reverse.īut although flat rate income taxes have received a flurry of interest in some states, graduated rate taxes remain far more common. While countries such as Estonia have seen their economies grow since. This includes 11 states that have flat rate personal income taxes in effect today and two more that are scheduled to join them within the next few years due to recently enacted legislation. A flat tax is a system where everyone pays the same tax rate, regardless of their income. In total, one-third of the 41 states with income taxes have opted for a flat rate.

While most states have a graduated rate income tax, some state lawmakers have recently become enamored with the idea of moving toward flat rate taxes instead.

0 kommentar(er)

0 kommentar(er)